America’s bank conglomerates – JPMorgan and Citigroup – shall deliver their Q2 2024 earnings result this Friday (12h July) before market open.

JPMorgan

JPMorgan is the world’s largest bank by market capitalization (nearly $600B). It offers a range of financial and investment banking services and products in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, brokerage and research.

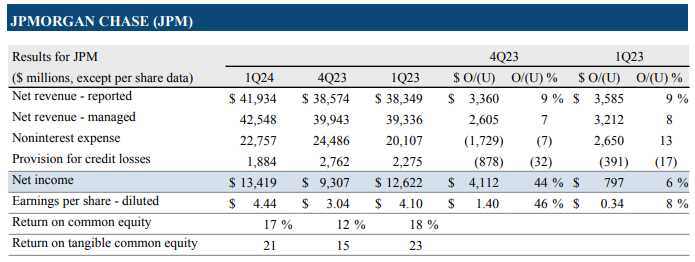

JPMorgan: Financial Measures. Source: Earnings Press Release

In Q1 2024, JPMorgan delivered $42.5B in net revenue, up 7% from the previous quarter, and up 8% from the same period last year. Excluding the First Republic, net income was $13.4B, up 44% from the previous quarter, and up 6% from Q1 2023.

By business segment, Consumer & Community Banking contributed the most to the bank’s revenue ($17.7B, but up only 7% (y/y), or just merely 1% (y/y) excluding First Republic); Corporate & Investment Banking reported a flat revenue to the prior year, at $13.6B; Asset & Wealth Management reported $5.1B in revenue, up 7% from the same period last year, but down -1% excluding the First Republic, reflecting net investment valuation gains in the prior year; Commercial Banking reported $4B in revenue, up 13% (y/y), or 3% (y/y) excluding First Republic, driven by higher noninterest revenue, partially offset by higher deposit-related client credit; Corporate reported $2.2B in revenue.

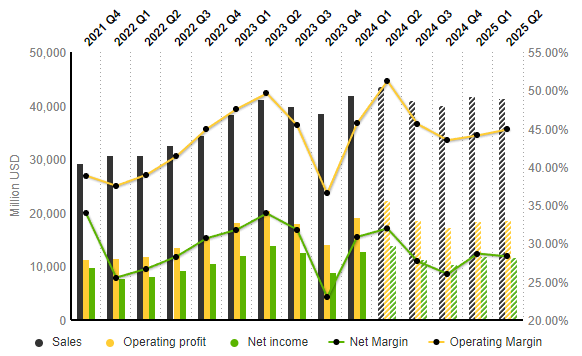

JPMorgan: Income Statement Evolution (Quarterly Data). Source: Market Screener

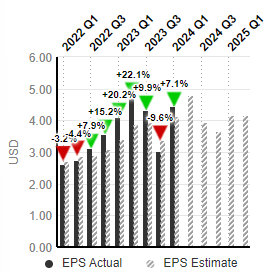

According to projections by S&P Global Market Intelligence, sales revenue for the coming quarter is expected to reach $43.6B, up 4.1% (q/q) and up 5.6% (y/y) respectively. Net income is projected to hit $13.9B, up 7.8% from the previous quarter. In addition, net margin is projected to improve slightly towards 31.96%, compared to the previous quarter’s 30.86%, but below Q2 2023 (33.92%).

EPS, on the other hand, is expected to hit $4.82, higher than the previous quarter by 38 cents. The EPS was $4.75 in Q2 2023.

Citigroup

Citigroup, formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998, has a market capitalization over $122B. It operates through Global Consumer Banking (traditional banking services for retail customers), Institutional Clients Group (fixed income and equity research, sales and trading, foreign exchange, prime brokerage, derivative services, investment banking and advisory services, private banking, trade finance and securities services), and Corporate and Other (un-allocated costs of global staff functions, other corporate expenses, un-allocated global operations and technology expenses).

In Q1 2024, Citigroup reported $21.1B in revenue, up 21% from the previous quarter, but down -2% from the same period last year. Gains were driven by growth across Banking USPB and Services, but partially offset by declines in Markets and Wealth. Net income also decreased to $3.4B (was $4.6B in Q1 2023), following higher cost of credit and expenses, as well as lower revenues. Lower net income has led to declining EPS, from $2.19 in the prior year period to $1.58.

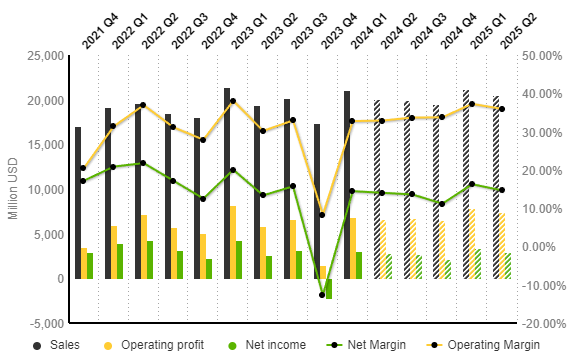

Citigroup: Income Statement Evolution (Quarterly Data). Source: Market Screener

Projections for Citigroup financial performance in the coming quarter remain flat. Sales revenue is expected to hit $20.1B, down -5% from the previous quarter, but up 3.3% from the same period last year. Net income is expected to reach $2.81B. Operating margin and net margin are not expected to have changed much from the previous quarter, at 32.88% (was 32.74% (q/q)) and 14.01% (was 14.44% (q/q)) respectively.

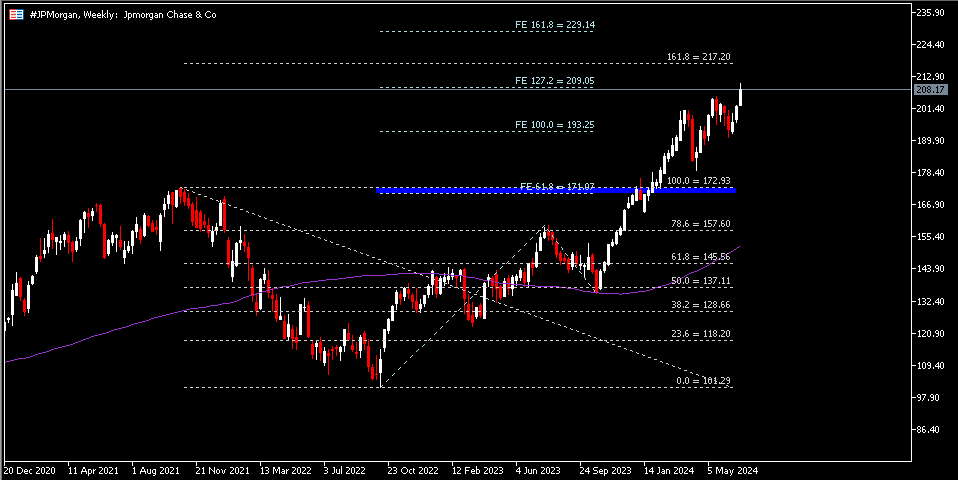

The #JPMorgan share price continues to ride on a bullish trend, currently testing resistance $209, a 127% FE level. A break above this level should indicate bullish continuation, towards the next resistance at $217 and $229. On the other hand, nearest support is seen at $193, then minor support zone $171-173.

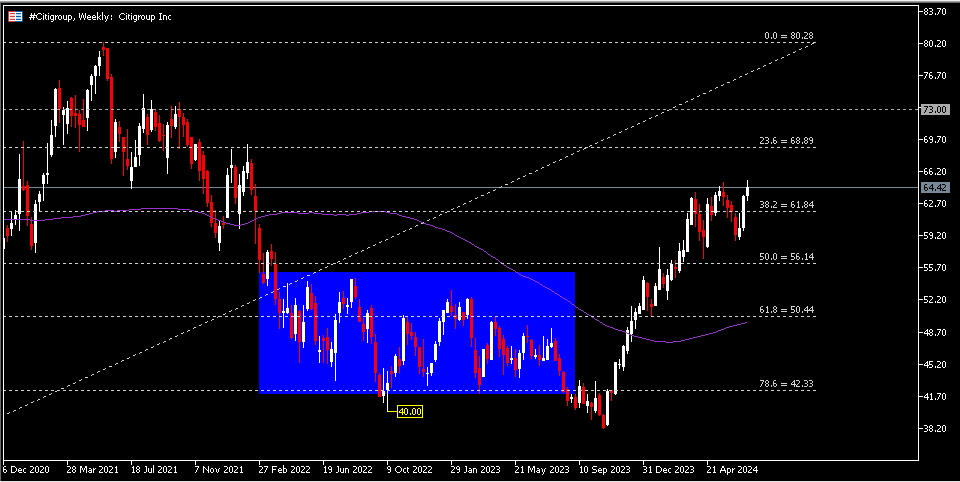

Similarly, the #Citigroup share price is also trending upward since gaining support by end of October last year. It has hit a new high since Feb 2022, and remains supported above $61.80 (FR 38.2%, extended from the lows seen in March 2020 to the highs seen in May 2021). The nearest resistance is found at $68.90 (FR 23.6%), then $73.00. On the contrary, if price breaks below $61.80, the next support to watch lies at $56.10 (FR 50.0%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.