September Fed rate cut all but a done deal, look ahead to Jackson Hole

- Dovish Fed bets have also boosted hopes of additional easing in Europe, and bonds are falling as markets look ahead to the Jackson Hole Symposium, which is expected to provide new guidance on the direction of US monetary policy.

- The anticipation of lower borrowing costs is boosting investor confidence.

- The US Dollar crashed to its lowest in 5 months. Cooler heads have prevailed as the panicked fears of recession dissipated. The FOMC is widely seen on track for -25 bp rate cuts over the remaining three policy meetings this year.

- Goldman Sachs reduced the likelihood of a US recession within the next year from 25% to 20%, citing the recent retail sales and jobless claims data. If the upcoming August jobs report, due on September 6, shows positive results, “we would likely lower our recession probability further to 15%,” Goldman economists led by Jan Hatzius noted in a report to clients on Saturday.

Asian & European Open:

- Asian stock markets traded largely higher overnight, however, European markets are narrowly mixed in early trade and US futures are in the red.

- The Hang Seng and tech stocks led the way overnight. The Nikkei underperformed and corrected -1.8%.

- The German 10-year rate is down -1.6 bp, the 10-year Gilt -2.3 bp and the US 10-year yield -1.3 bp.

Financial Markets Performance:

- The USDIndex has remained under pressure and hit a session low of 102.00, before picking up slightly.

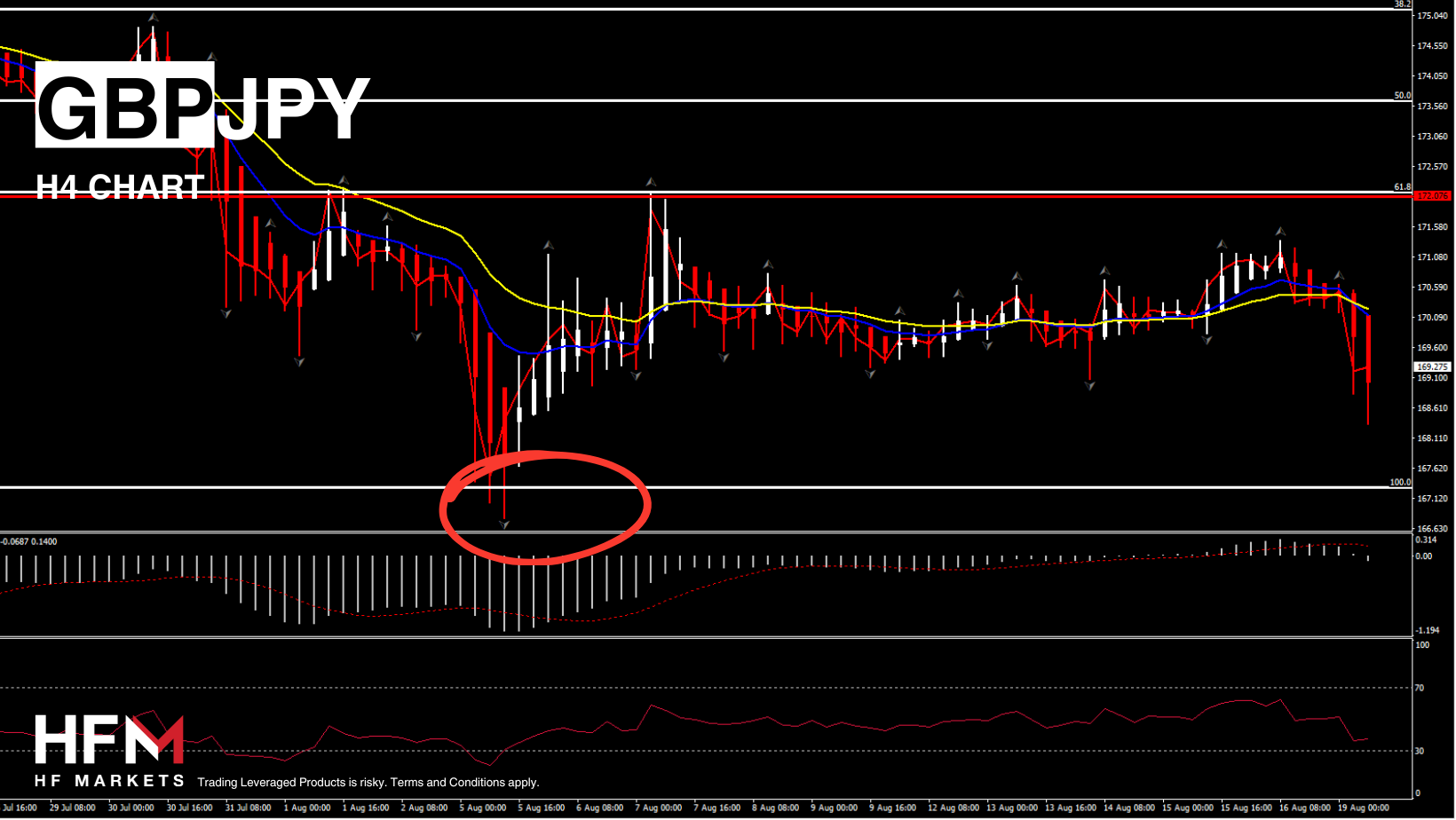

- The Yen strengthened by 1% against the US Dollar, reaching 145.17 today. The yen’s rise is driven by overall USD weakness, anticipation of BOJ Governor Ueda’s parliamentary appearance on August 23, and Fed Chairman Powell’s speech at Jackson Hole. Markets are looking for signals from Ueda on the future direction of the BOJ’s interest rate policy. Political uncertainty is also influencing expectations, following Prime Minister Fumio Kishida’s announcement that he will not seek re-election as president of the ruling Liberal Democratic Party in September. Some investors are still betting on potential BOJ interest-rate hikes and may be buying Yen ahead of speeches by the US and Japanese central bank leaders later this week.

- USOil prices have also continued to struggle as demand concerns dominate. The USOIL is currently below $75 per barrel as traders tracked US-led efforts to secure a cease-fire in the 10-month old Middle East conflict, while the Russia-Ukraine war is escalating.

- Gold rallied to an all-time high over $2500 per ounce,on hopes the Fed is edging closer to cutting rates.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.