The British Pound rallied to over $1.3000 the highest since July 2023, as the US dollar weakened. The dollar has fallen as expectations of Fed rate cuts increased, dragging the dollar index to its lowest level in 2024.

Meanwhile, the UK economy showed strong growth in the second quarter, bouncing back from last year’s mild recession. However, public sector borrowing in July reached £3.101 billion ($4.04 billion), the highest for that month since 2021, highlighting fiscal challenges for the new finance minister. Investors are also watching for insights from Fed Chair Jerome Powell’s speech at the Jackson Hole conference on Friday.

Meanwhile, the US Dollar on Wednesday fell by -0.31% and recorded a fresh 7-month low. The strength in stocks on Wednesday reduced liquidity demand for the dollar. In addition, a larger than expected downward revision to US payrolls for the year ending March suggested less job growth in the US labour market than previously reported, a dovish factor for Fed policy. The dollar slumped to its lowest level on Wednesday afternoon when the minutes of the 30-31 July FOMC meeting showed that ‘most’ officials saw a rate cut in September as appropriate.

The US Bureau of Labour Statistics (BLS) revised US payrolls down by -818,000 for the year to March, more than the expected decline of -600,000 and the largest downward revision since 2009, signalling less job growth than previously reported.

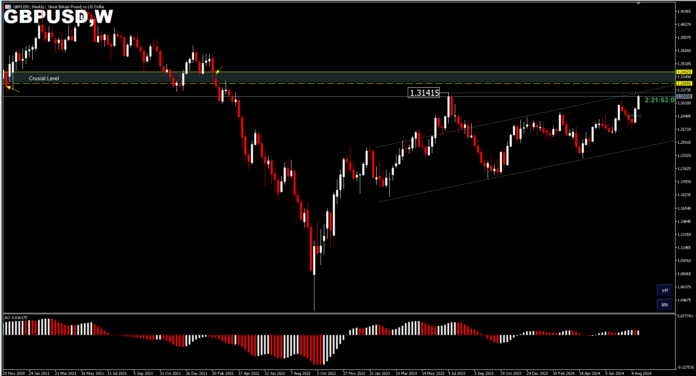

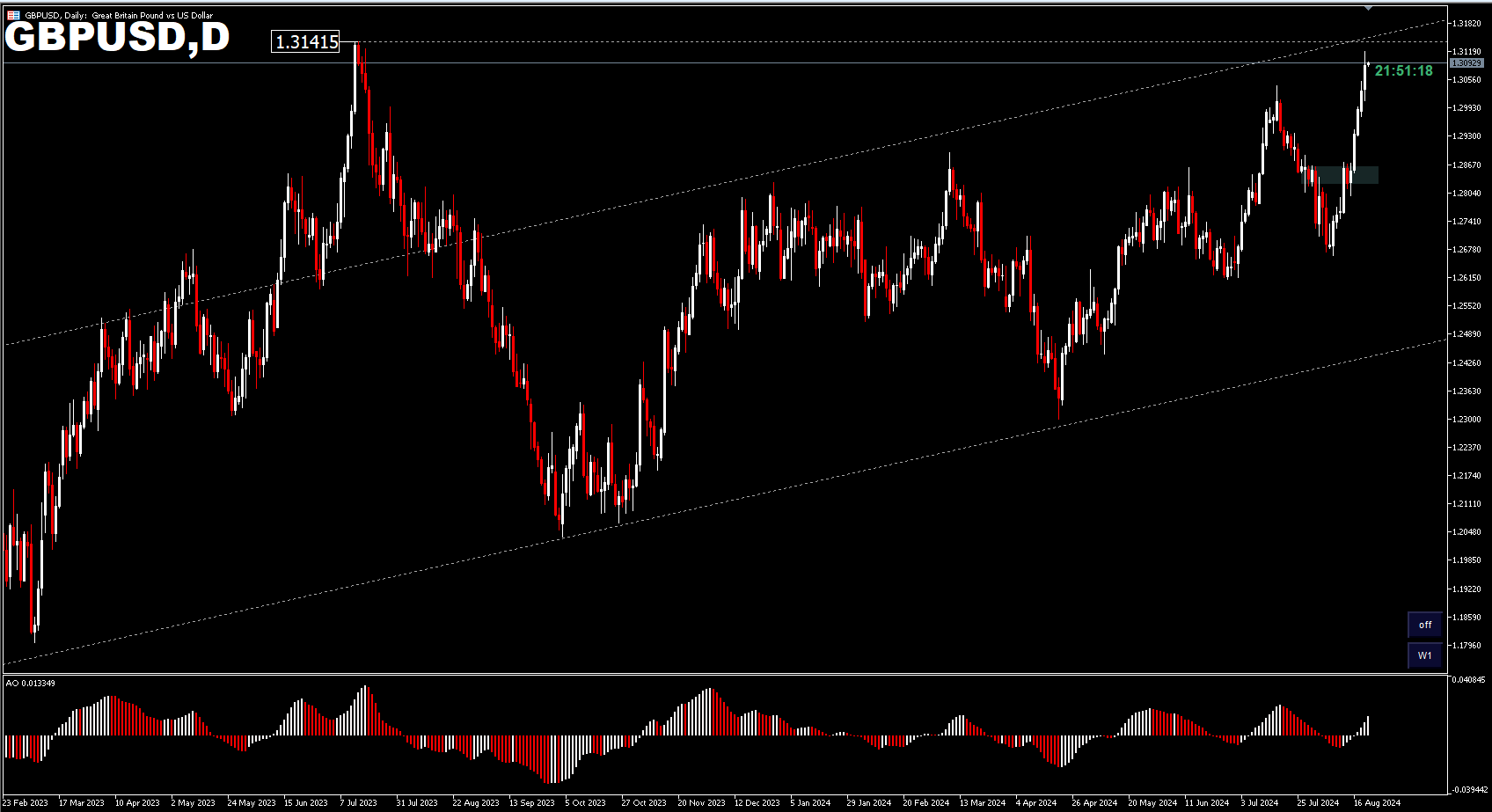

The GBPUSD pair is moving close to last year’s July high of 1.3141. This is a significant level for traders to watch. Attempts to move higher, even the formation of a bull-trap may occur. However, a weekly price close above this level this week, will confirm the continued trend direction with a possibility to test the average high price in the range of 1.3250- 1.3400. Meanwhile, a false breakout of this level, could take the pair into consolidation, to decline mode.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.