Microsoft Corp., an American multinational technology conglomerate which actively engages in the development and support of software, services, devices and solutions, shall report its financial results for FY25 Q1 on 30th October (Wednesday), after market close. The company is currently ranked the world’s third most valuable company by market cap ($3.18 trillion), after Apple.Inc and Nvidia.

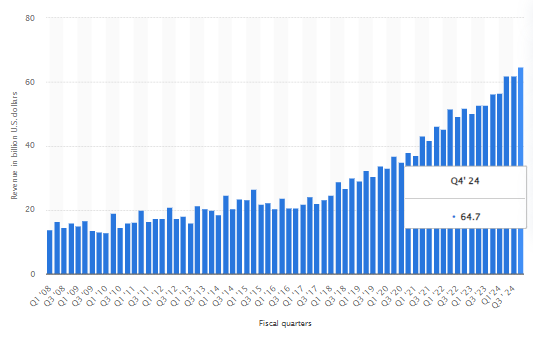

Microsoft’s Revenue (in billion USD). Source: Statista

Microsoft derives its revenues from three main segments. The first segment is Productivity and Business Processes, which includes products and services such as Office Commercial, Office Consumer, LinkedIn and Dynamic Business Solutions. The second segment is Intelligent Cloud, which includes various Server Products and Cloud Services, as well as Enterprise Services. The third segment is More Personal Computing, involving Windows, Devices, Gaming, Search and News Advertising.

In general, Microsoft’s revenue in the previous quarter reached $64.7B, slightly up 4.5% from Q3 FY 24, and up over 15% from the same period last year. The company’s quarterly revenue has quadrupled within the last twelve years. Based on these past data, the largest increase in quarterly revenue was more than $6B, which was seen between Q1 and Q2 2010.

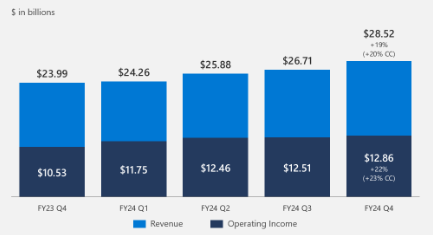

Intelligent Cloud: Revenue and Operating Income. Source: Microsoft

In the previous quarter, the Intelligent Cloud segment continued to contribute the most to the company’s revenue, at $28.52B (+18.9% (y/y)). On the other hand, operating income grew over 22% (y/y) to $12.86B. Such a result was mainly from Azure and other cloud services in response to growth in consumption-based services.

In general, despite Azure’s growth displaying some constraints in the recent quarters following capacity limitations, market sentiment remains optimistic, buoyed by Microsoft’s significant investments in AI infrastructure, anticipated increase in demand for AI-related cloud services, easing optimization pressures, etc. Analysts projected Azure’s growth rate to hit 35% in the coming quarters.

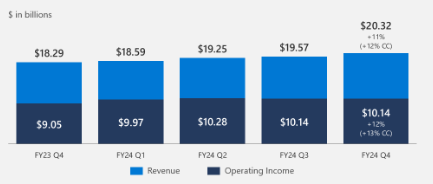

Productivity and Business Processes: Revenue and Operating Income. Source: Microsoft

Productivity and Business Processes, on the other hand, reported $20.32B in revenue, up 11.1% from the same period last year, driven by sales growth in Office Commercial, Consumer and Dynamic Products as well as LinkedIn. The segment’s operating income grew 12% (y/y) to $10.14B. The company could continue to position itself as a leader in AI-driven productivity solutions, following Microsoft’s 365 offerings and ChatGPT that serve as a foundational ecosystem for future AI advancements.

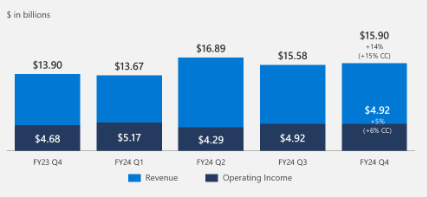

More Personal Computing: Revenue and Operating Income. Source: Microsoft

Lastly, More Personal Computing drove $15.9B (+14.4% y/y) in sales, boosted by net impact from the Activision Blizzard acquisition, sales growth in Xbox content and services, higher search volume and news advertising, slightly offset by a sales decline in Xbox hardware and in Devices segment, as the company continues to focus on higher margin premium products. Operating income was up over 5% (y/y) to $4.92B.

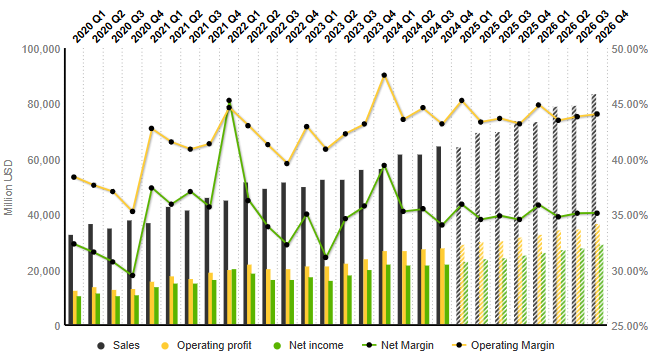

Microsoft: Income Statement Evolution (Quarterly Data). Source: Market Screener

In the coming quarter, the S&P Global Market Intelligence projected sales revenue to remain flat at $64.6B, slightly down -0.26% from the previous quarter, but up over 14% from the same period last year. EBITDA is expected to be up 1.81% (q/q) and over 13% (y/y) to $34.9B. Net Income is projected to reach $23.2B, up 5.2% from the previous quarter, and up nearly 4% from the prior year.

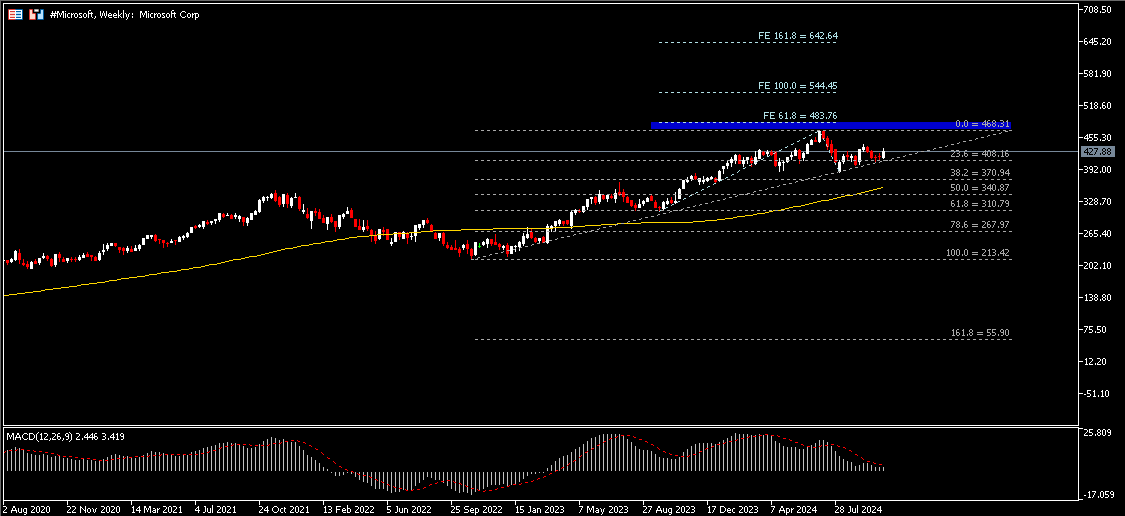

Technical Analysis:

#Microsoft, Weekly: The Microsoft share price last closed above $408 (FR 23.6% extended from the lows in October 2022 to ATH formed in June 2024). The ATH $468.31 together with $484 (FE 61.8%) form the nearest resistance, followed by $544. A break below $408 may suggest short-term technical correction, with next support at $371 (FR 38.2%) and the 100-day SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.