- Stocks on Wednesday corrected back to their previous price lows due to economic and employment data making the monetary policy’s future uncertain.

- Meta Platforms declined 3.00% as the company warns investors of heavy spending in the upcoming quarter, particularly on AI. Meta’s revenue and EPS beat expectations.

- Microsoft stocks fall 3.70% as the company forecasts slower growth for the last quarter of 2024. Microsoft’s revenue and EPS beat expectations.

- The Japanese Yen rises against all currencies as the Bank of Japan confirms they still see more rate hikes taking place.

- The UK’s first female Chancellor raises taxes and the country’s debt allowance.

SNP500 – US Stocks Decline On Monetary Policy Uncertainty!

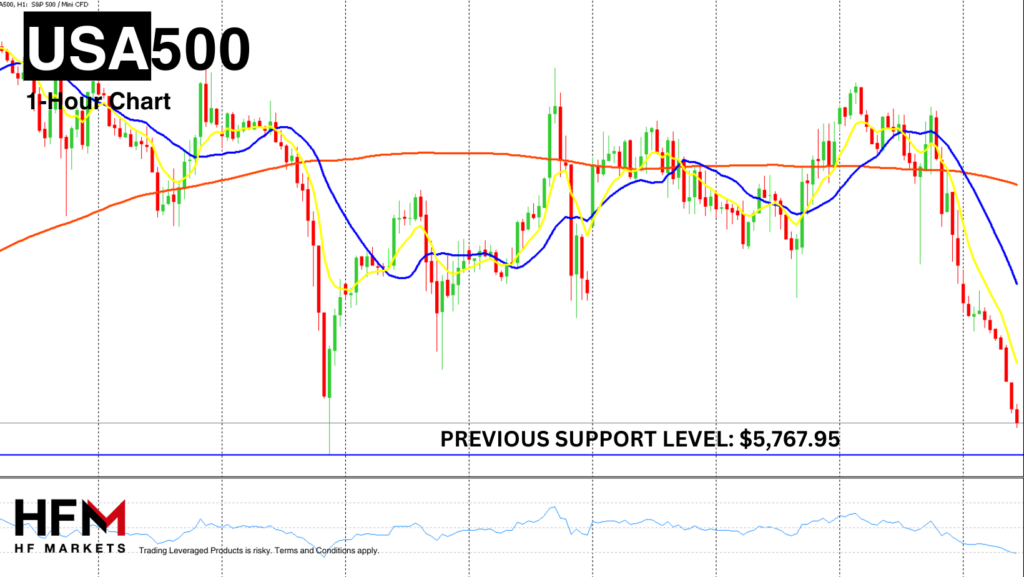

The SNP500 is trading 1.20% lower since Wednesday’s opening price. The index is also close to dropping to its lowest price since October 10th. The reason for the decline is partially due to uncertainty regarding the Federal Reserve’s monetary policy but also due to certain comments from Microsoft and Meta’s board of directors. However, as the price declines traders should note that the price is falling closer to the support level at $5,767.75.

The main price drivers on Wednesday were October’s ADP Employment Change and the latest Gross Domestic Product. ADP Nonfarm employment increased by 233,000, surpassing the forecast of 110,000 and the previous 159,000. The largest job gains were in education and healthcare (53,000) and trade, transportation, and utilities (51,000), with growth in these sectors at its fastest since July 2023.

The US GDP grew by 2.8%, below the 3.0% estimate, driven by rising domestic demand. Personal spending increased by 3.7%, the highest since 2023, and federal spending grew by 9.7%. These economic releases, particularly the ADP Employment Change reversed thoughts of a weakening employment sector. This strong labor market and stable GDP don’t meet the Fed’s conditions for major interest rate cuts. Analysts still expect a 0.25% basis point interest rate cut at the Fed’s November meeting, but December’s rate decision remains uncertain.

Without a rate cut in December, the stock market becomes slightly less attractive but that may not necessarily be enough to drive the price significantly lower. The Chicago Exchange advises a rate cut of 25 basis points next week is almost certain. However, there is a 31% chance the Fed will pause at the December meeting.

Investors were hoping for support from Microsoft and Meta’s earnings for the SNP500 and the stock market in general. Both companies did beat the Earnings Per Share and revenue expectations. However, certain elements of the report triggered a lack of demand. The shares declined after the company warned of slowing growth and projected ongoing increases in artificial intelligence-related spending. This was also similar for Meta. 9% of the SNP500 is exposed to Microsoft and Meta.

Investors will now be monitoring how the SNP500 reacts to the price declining down to the support level at $5,767.75. This level prompted a quick upward surge on October 23rd. Technical analysts also note that if the price climbs back above $5,834, the Moving Averages will form a crossover and the price will rise above a key Fibonacci level. However, for this to remain a possibility, investors will ideally be hoping for a weak Core PCE Price Index, Employment Cost Index and higher Weekly Unemployment Claims.

GBPJPY – New UK Budget & Rate Hike Signals From the BoJ

The Japanese Yen is the best performing currency while the US Dollar is the second best performing currency of the day. Therefore, some conflicts can be seen there on the USDJPY. Instead many traders are concentrating on the GBPJPY as the UK has now made public its new government budget. The GBP Index is trading 0.09% lower so far, but investors will monitor how these two currencies react as the UK session opens and the Asian session nears a close.

The Japanese Yen primarily rose in value due to the Bank of Japan Governor’s comments (Kazuo Ueda). Even though the BoJ kept interest rates the same, the governor indicated that the central bank is on track to increase rates again in the upcoming months. However, the governor did advise this would also depend on the inflation rate, GDP and external factors. These external factors are referring to the US Presidential Election and the outcome.

UK Finance Minister Rachel Reeves stated that the previous government left a £22 billion deficit in public finances. To address this, she proposed £40 billion in tax increases, including raising the employer National Insurance rate from 13.8% to 15% and Capital Gains Tax from 10% to 18% for low-rate and from 20% to 24% for high-rate taxpayers.

So far the GBP (Great British Pound) has not seen significant bearish momentum, but the Pound is trading slightly stronger during this morning’s UK opening hours. Investors looking to short the GBPJPY should also take notice of the support level at 196.630.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.