FX News Today

- The Dollar and Yen have weakened moderately against most other currencies, though the Australian Dollar has been an exception, with the antipodean currency underperforming following a weak industrial profit figure out of China.

- Topix and Nikkei closed with gains of 4.89% and 3.88% respectively, following gains of nearly 5% in the US stock markets.

- The stock market bounce, amid thin volumes, was due to US 2018 holiday sales rising by 5.1 percent from a year ago to over $850 billion, the strongest gain in six years.

- The stock market rally did not push through to China, as the Hang Seng lost early gains and is down -0.46% while Shanghai and Shenzhen Comp are down -0.17% and -0.15%. The CSI 300 is hanging on to a slight 0.13% gain.

- DAX and FTSE 100 futures are moving higher, but US futures are in slightly negative territory, indicating that markets remain fragile and oil prices erased some of yesterday’s jump, leaving the front end WTI future at USD 45.98 per barrel.

- Uncertainty also eased as words of confidence from President Trump’s economic adviser on Fed Chairman Powell and Treasury Secretary Mnuchin helped to underpin risk appetite.

Charts of the Day

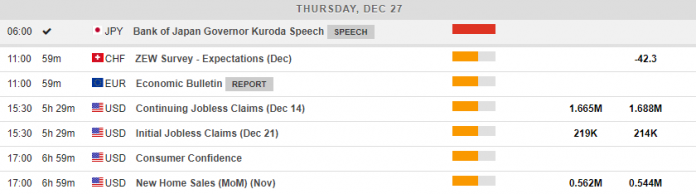

Main Macro Events Today

- ECB Economic Bulletin – The ECB Bulletin includes the statistical data that the ECB Board evaluated when making the latest interest rate decision and provides a detailed forecast and overview of the Euro Area economic conditions.

- US Jobless Claims – Continuing Jobless Claims are expected to have declined in the past week, while Initial Jobless Claims are expected to have increased, thus providing a mixed picture of the US economic outlook.

- Conference Board Consumer Confidence – The Consumer Confidence Index is expected to be lower than the previous month, albeit still significantly higher than 100, thus suggesting that growth will persist.

- US New Home Sales – New Home Sales are expected to have increased by 0.562 million in November, compared to 0.544 million in October, suggesting that the housing market is still growing.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.