The second biggest entertainment company in the world, Walt Disney Co. (DIS) (MT5 – #Disney), is one of the most severely affected of the Covid-19 pandemic and consequent lockdowns, with theme park closures, cancellation of cruise ship trips, delayed movie releases and hits to advertising revenue.

Disney will report earnings for Q4 2020 on November 12, 2020 after market close. The company’s fiscal year ended in September. Analysts expect the company to report its first adjusted loss per share in at least four years as revenue plummets year over year (YOY) for the second quarter in a row. Q3 2020 earnings beat analysts’ expectations by a wide margin but it was the company’s worst quarterly report in recent years. Adjusted earnings per share (EPS) plunged 94.0% as revenue sank 41.9%.

As the expectation is for Disney’s losses to pile up in the quarterly report, investors will closely look at the company’s streaming business report. In October, Disney announced a reorganization to focus on its streaming business, Disney+. The move comes as the theme parks segment continues to deal with pandemic restrictions. Some of its theme parks have been reopened, but with limited capacity. Since the launch of Disney’s streaming service, Disney+, almost one year ago, fans have been able to watch their old Disney favourites and watch new smash hits for the first time. The enticement of the Disney-centric streaming service has been successful, with over 60.5 million subscribers as of August, way ahead of the projected forecast subscribers. The company predicted it would reach between 60 million and 90 million subscribers by 2024, but smashed that prediction by gaining as many in the first year of operation.

Analysts are forecasting Disney’s meagre performance to persist in Q4 2020. Revenue is forecast to fall 26.8%. After seven straight quarters of falling adjusted EPS, Disney is expected to report its first adjusted loss per share in at least 16 quarters. Analysts expect Disney to report a loss of 90% per share in the last quarter. After adjustment this would equal out to 73% . The Wall Street consensus is for $14.1 billion in revenue, which would be down 26% year-over-year. For all of FY 2020, analysts estimate annual adjusted EPS and revenue to decline 73.1% and 7.1%, respectively. The biggest decline in seven years.

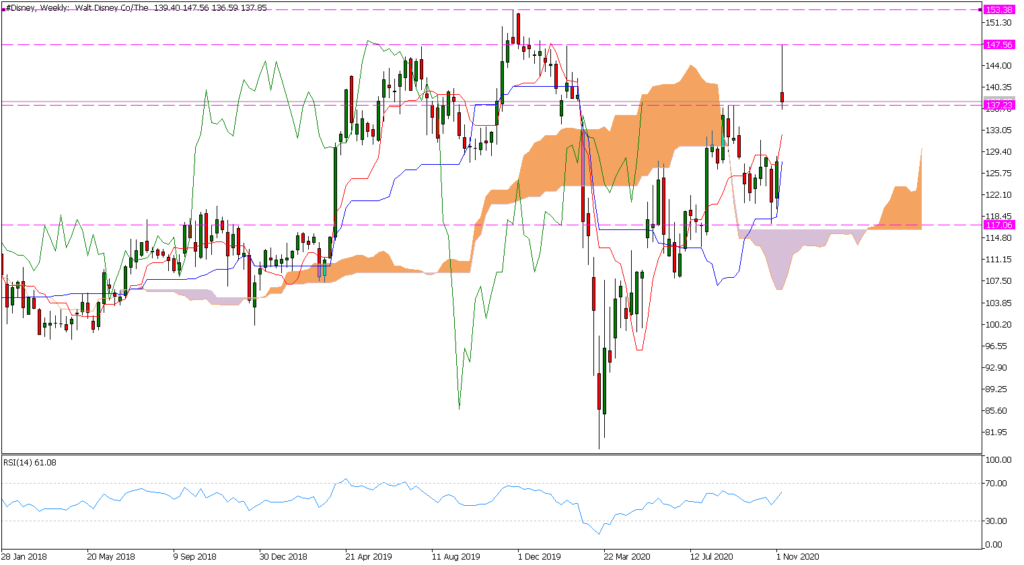

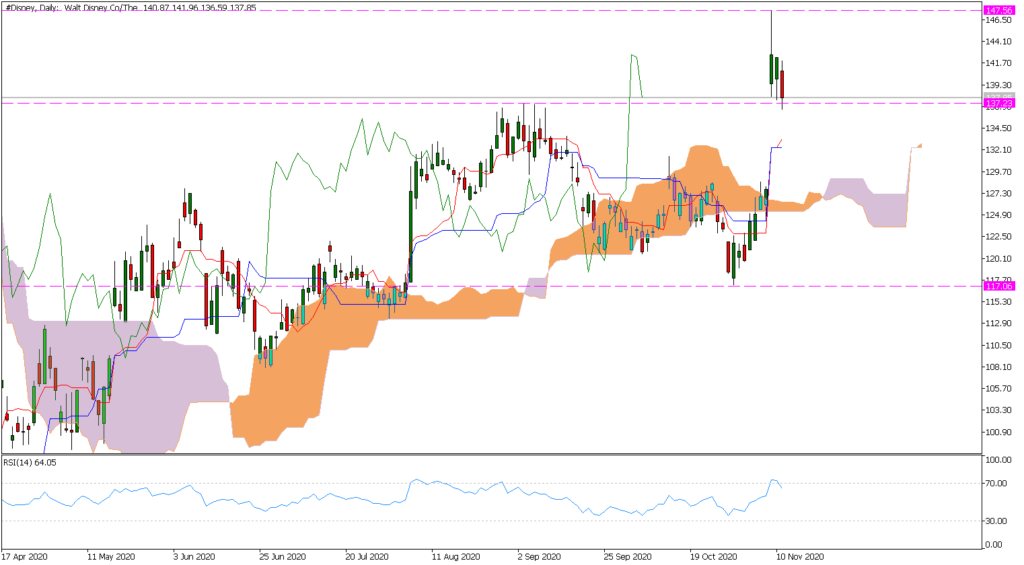

Disney’s DMA stock has rebounded from its mid-March low at a slower pace than the rest of the market following the coronavirus-induced crash that began in late February. On Monday, Disney DMA stock staged a breakaway gap to a 2020 high at $147.56 after Pfizer (PFE) announced its COVID-19 vaccine was more than 90% effective. Since then, it declined 6.58% and closed at $137.85 on Wednesday, close to the September high $137.20. Bulls need to keep the price above $137.00 to keep the momentum alive. A break below $137.00 will put the kijun-sen as the nearest support at $132.38.

Barrons reported that the Wall Street analysts are bullish leaning on Disney DMA stock, with 64% having a Buy or equivalent rating, while 36% recommend a Hold. No analyst rates Disney at Sell. But their average target price is $138—similar to the stock’s recent level.

Click here to access the Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst, HF Education Office Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.