Oil prices continued their drop yesterday, reaching a low of $46.10, as OPEC countries face conflicting priorities, given that the oil cartel’s member do not appear willing to curb production, especially as prices continue to drop. As a recent Bloomberg report points out, OPEC countries have surpassed their target by an average of 37% in 2018, even though the deviation appears to have eased some in the last two months. Add to that the continuous increase in shale oil production, especially in the US, where production is expected to increase to 8.2 million barrels per day, crossing the 8 million threshold for the first time, and with new drills added every day.

Shale oil appears to be the big alternative to crude oil, as the whole procedure for the former is estimated to cost less than $30, making the procedure profitable even when lower prices prevail. Tight oil (also part of the “shale oil” terminology, but refers to oil trapped in sand shale, requiring fracking to extract) breakeven points appear to be around $50, even though many producers would be profitable with prices lower than $40 per barrel. The possibility for shale oil production (in the broader sense) appears to have put a ceiling over oil prices, something that renewable energy resources have yet not been able to achieve.

Lower oil prices are expected to harm oil producers disproportionately, even though they still have room to go before they reach the breakeven point. Using 2016 data, Saudi Arabia, Iraq, and Iran are estimated to have a cost of production around $10 per barrel, while Russia has an estimated cost of $19 per barrel. Thus, at least for the time being, there is still no incentive to produce less, despite the fact that there would most likely be a disproportionate increase in the price. Naturally, given that the Oil price is primarily affected by political factors, the possibility for an actual production cut cannot be ruled out.

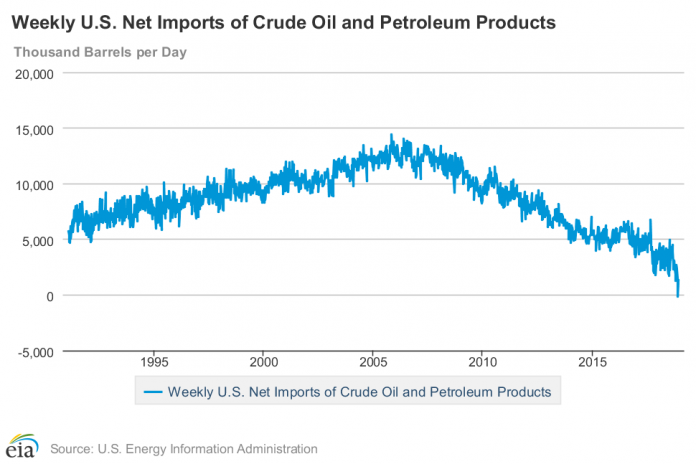

What do the above mean for the two largest economies in the world? The fact is that both the EU and the US have much to gain from the drop in oil prices. Both countries are heavy importers of Oil and, even though the US has been slowly reducing its dependence on foreign sources of oil (first graph of the post), the decrease in the price is likely to assist both economies. The rationale for more growth lies in two points: first, the supply of both Euros and Dollars abroad will decrease (for more on this have a look here), hence pushing both currencies higher with respect to exporting countries which will see their trade surpluses reduced. Second, the spending power of people in both countries will be increased given that they would be spending much less on fuel and have more money to spend around. This can already be seen in the behaviour of the USD and the EUR against the Aussie and the Loonie, both currencies closely related to Oil price developments.

Higher economic growth is, as previously suggested, usually associated with higher core inflation, i.e. the inflation related to the domestic economic and not taking Oil prices into consideration. This will provide support to the Fed’s expected rate hike tonight and will also pave the way for a milder reaction to the higher interest rate environment through 2019. If low Oil prices persist, there is actually the probability of seeing a return of the three rate hikes forecast, however, this event appears rather distant at the moment. The same holds for the Euro, even though it is unlikely that the already set forward guidance for a rate hike in September will change, but the possibility for another hike in late 2019 will be increased.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.