In the US, approximately 68% of overall GDP can be attributed to Personal Consumption Expenditure (PCE), with similar percentages registered for other countries as well. Note that since overall GDP measures the amount of goods and services produced via the expenditure method (among other methods), having one variable accounting for that much surely underlines its importance. In general, PCE measures the amount of money that consumers have spent on goods and services in the previous quarter and hence provides an overview of how people feel about the state of the economy. If the PCE growth rate is negative, then consumers have either decided to spend less on a whim, or they are able to purchase less. The latter could be due to either of three causes: higher supply-side inflation, higher unemployment or wage cuts. In the first case, if this is just a short-lived reaction, we can expect that negative growth will not persist for long. However, in the other three cases, we can expect the negative pressures on GDP to be more persistent.

Unfortunately for investors, there is a significant lag between each PCE data release, given that they are published only once per quarter. To avoid this lag, a monthly publication called Retail Sales is released, aiming to capture shorter-term developments in consumption expenditure. Retail Sales collect total retail turnover from retailers to gauge how personal consumption has changed. Given its monthly frequency, Retail Sales data tend to be noisier and more prone to seasonal patterns. To this end, my personal preference is to look at both m/m and y/y growth rates to gauge both the short-term and the long-term trend in the data. In addition, due to the increase in noise, one-off negative effects should be overlooked.

Retail Sales data are widely used by financial markets as well as policymakers, as Central Banks use retail sales to analyze trends in consumer purchases and overall demand-side inflationary pressures as part of their overall analysis of the economy. Since Retail Sales are measured across all sectors of the economy, all industries are directly impacted by these data, hence stock markets are also directly affected. To this end, the release of the Retail Sales Report can cause volatility surges both in the FX and the stock market. Retail Sales, serving as a proxy for private consumption, can also provide signals regarding recessions.

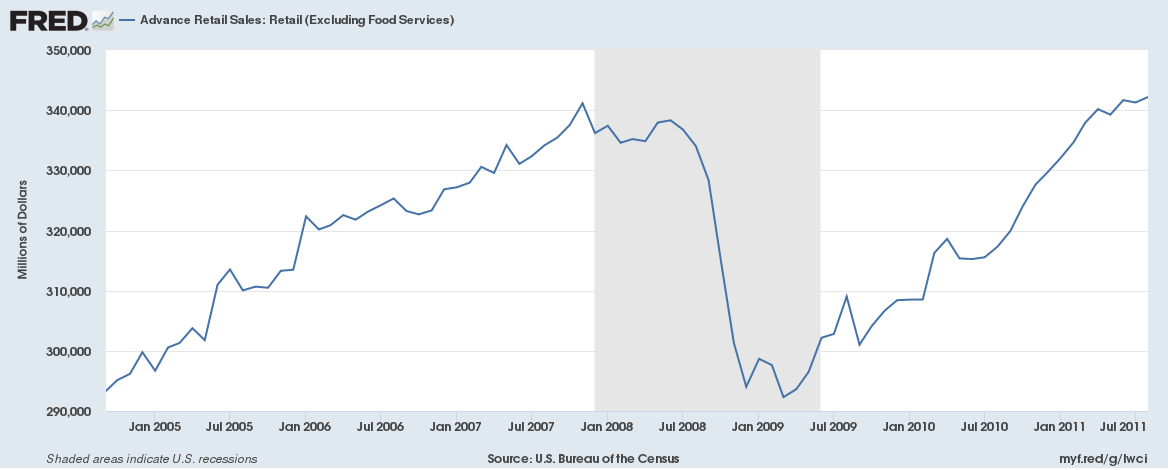

As the Figure suggests, retail sales started to drop in December 2007, stabilizing at a lower level and then moving on to deteriorate further from July 2008 onward. By the time the US economy was officially declared as being in a recession on December 1, 2008, retail sales had already declined almost 11% since June 2008, and about 12% since their peak in December 2007. Similar to this, Retail Sales started to increase in April 2009 and continued their upward trend, despite the occasional down month, way before the September 2010 data officially declared that the recession had ended.

It is especially because of its importance as a forward-looking variable that Retail Sales can cause volatility surges, even if this proves to be a false alarm given the large amount of noise in the series. Remember again that expectations matter and hence what we should observe is how far off the reported figure is from the consensus forecast.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/09 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.