-

USD (USDIndex 93.82) کافیChoppy session ہے.Yields spreadجارہے ہیں

March lows 2020 کی طرف.(2y & 5yr higher) اور(10yr & 30yr lower) Catalyst میںInflation worries ہیں اورQE BoC کیSurprise ending اور

Stocks down .Earlier rate hikes ہیں.Oil میں کمی.Durable goods میں کمی لیکن کافی برا نہیں تھا.Trade balance اپنےRecord $96.3 bn پر ہے. -

US yields 10yr) میں Crash اور1.529 پر Close ہوا.)Asian Session میں اب یہ1.57% اوپر ہے.

-

Equities میں کمی

USA500 -23 (-0.51%) at 4551 (DOW -0.75%) – Big movers MSFT +4.21%, GOOGL + 4.96%, EXXON -2.6%, JPM -2.08% USA500.F back to 4545. Asian equities weaker. -

USOil میں کمی کیونکہInventories زیادہ

double build – at 4.3m vs 2.0m & draw down last week of 400k barrels. Low $79.39 earlier from $83.70 on Monday. -

Gold میں Recovery ہوئی$1783 سے. اب$1800 سے اوپر ہے.

- FX markets – EURUSD 1.1600, Cable 1.3750, USDJPY now 113.70

ECB Preview:

Last meeting میں Signal دیاتھا کہDecember تکPEPP اورOlder PEPP والے Program میں کوئی Changes نہیں کی جائیں گی. اس کے باوجود مارکیٹ اس سے Related خبروں کے منتظر ہیں.ECB Market کافیFlexible ہوگی اگر کوئی Emergency ہوئی تو.ECB ان سب کے باوجودDovish signal دے سکتاہے.December والی Meeting میں Confirm ہوگا کہPEPP اس سال March میں End ہوگا کہ نہیں.

Today – German Unemployment, EZ Consumer Confidence, US GDP, PCE Prices Advance, Weekly Claims, ECB Policy Announcement and Press Conference Earnings- Airbus, AB InBev, Carlsberg, Evolution Gaming, Nokia, Saint Gobain; Shell; Amazon, Apple, Comcast, Merck, Caterpillar, Mastercard, Yum!, Shopify.

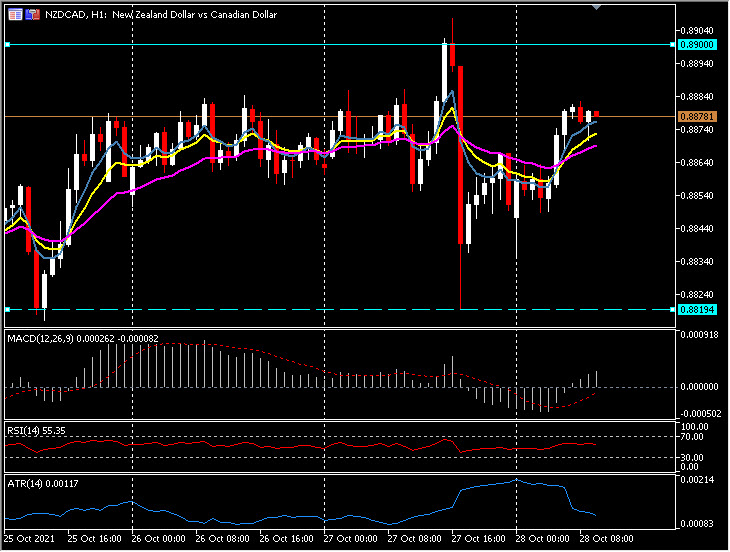

Biggest FX Mover

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.