- USD (USDIindex 95.25) جمعہ سے حاصلات کو برقرار رکھتا ہے، پہلے 953.8 پر دھکیل رہا ہے۔

- US yields 10-yr پھر سے اوپر چلا گیا اور %1.818 پر تجارت کرتا ہے۔

- Equities – US کل بند ہوا۔ Nikkei -0.27% – USA500 FUTS نیچے دوبارہ 4633 پر۔

- USOil – انتہائی سخت سپلائی کے طور پر $84.70 سے زیادہ بڑھ گئی، صنعاء اور NK پر سعودیوں کی جوابی کارروائیوں نے میزائلوں کی فائرنگ کا سلسلہ جاری رکھا جس سے جذبات متاثر ہوئے۔

- Gold – holds at $1815 from a test of $1823.

- Bitcoin ایک اور ڈاؤن دن، $41,600 پر ٹیسٹ کیا گیا، اب واپس 42,200 پر آگیا۔

- FX مارکیٹس – EURUSD واپس 1.1400 پر، USDJPY اب 114.80 کا ٹیسٹ 115.00 پہلے، کیبل واپس

200hr MA 1.3620ٹیسٹ کرنے کے لیے، UK ملازمتوں کے ڈیٹا کے بعد +20 pips۔

Overnight

European Open

Today – German ZEW, Empire State Manu. Index & Earnings from Goldman Sachs. Day 2 of DAVOS (on-line).

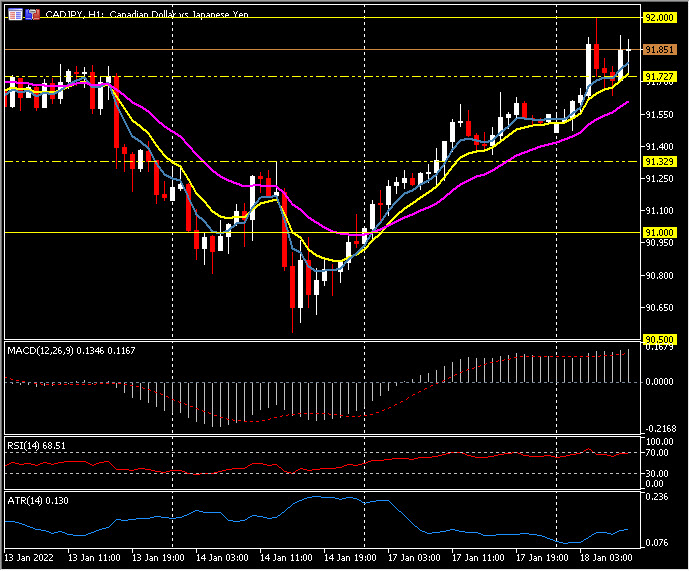

Biggest FX Mover @ (07:30 GMT) CADJPY (again) (+0.34% again) Rallied all day over 91.73 (Thursdays high) and onto test 92.00. MAs aligned higher, MACD signal line & histogram higher & above 0 line. RSI 68 rising, H1 ATR 0.131 Daily ATR 0.804.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.