昨天,俄罗斯-乌克兰在土耳其会议后,股市随着风险情绪重启而上涨(纳斯达克+3.59%,日经指数+3.8%)。由于阿联酋表示将增加产量,但不会与欧佩克决裂,石油价格下跌(一度为-12%)。黄金下跌 85 美元,日元和瑞郎下跌,因为避险资产下跌(美元兑日元超过 116),美元也下跌,欧元在欧洲央行之前创下几个月来最好的一天(欧元兑英镑回到 0.8400)。澳元和纽元也维持买盘。收益率下降,比特币停滞在 42,000 美元的关键水平,损失超过 2,000 美元。由于大量进口,隔夜日本 PPI 下降至 9.3%。

- 美元(美元指数 98.04)。从昨天的 99.06 以上冷却至 97.80,然后回升至 98.00。

- 美国 10 年期国债收益率收盘时高达 1.948 – 现在低至 1.934%。昨天的 10 年期拍卖以 1.92 成交。

- 股指 – USA500 +107 (+2.57%) 4277。US500 指数期货 现在下跌至 4270。科技股上涨超过 5%((谷歌、微软、NFLX 和 TWTR)。随着油价暴跌,XOM 下跌 -5.6%。亚马逊 +2.4% 宣布 20 比 1 的股票分割。

- 美原油 – 从周二的高点 124.90 美元跌至昨天的 99.70 美元。现在 107.50 美元。

- 黄金 – 从周二高点 2070 美元跌至现在的 1975 美元以下。

- 比特币昨天测试了 42,000 美元的关键水平,然后反转至 40,000 美元以下,现在交易价格为 39,300 美元。

- 外汇市场 – 欧元兑美元回升至 1.1050 上方,美元兑日元守住 116.00 上方,英镑兑美元目前升至 1.3190。

欧洲开盘 – 6 月 10 年期德国国债期货上涨 15 个基点至 163.75,表现优于国债期货。整个亚洲的收益率都走高,但由于人们对乌克兰和俄罗斯今天在土耳其举行的预定外长会议上达成协议的希望存有疑虑,昨天主导的避险资金流动的广泛逆转已经开始失去动力。美国期货普遍走低,即使 DAX 和 FTSE 100 期货延续昨天的涨幅。油价的调整缓解了近期的一些压力,至少对欧元区而言,鉴于俄罗斯入侵乌克兰和不断升级以及西方与俄罗斯之间的紧张关系,欧盟国家元首将同意联合发债为能源和国防政策提供资金,这也来自国内的支持。

欧洲央行前瞻 – The ECB meets today and another joint debt package would increase the central bank’s room to extend net asset purchases, which most now expect the central bank to keep open ended at today’s meeting as warnings of stagflation fears dominate the headlines. Still, the ECB can’t afford to do nothing and may find a way to change strategy and open the way to hike rates, while still buying bonds.

Today – US CPI, ECB Policy Announcement & Press Conference (Lagarde), Weekly Claims, Russia-Ukraine Foreign Ministers in Turkey & EU Leaders Summit, RBA’s Lowe.

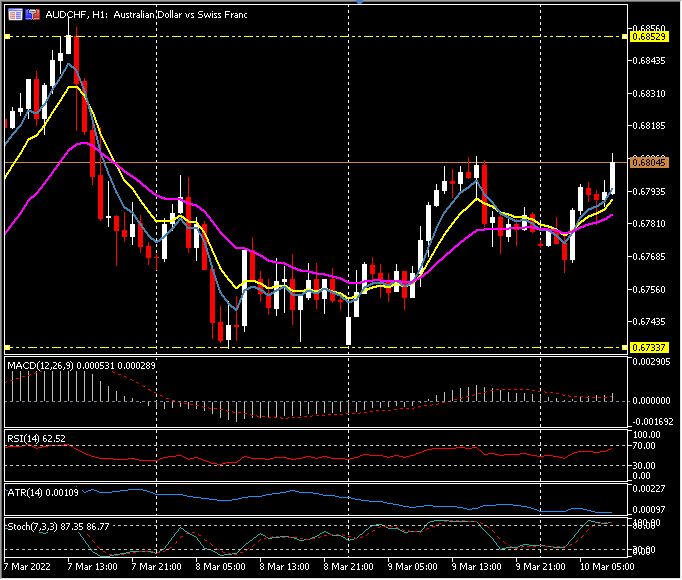

Biggest FX Mover @ (07:30 GMT) AUDCHF (+0.40%) Rallied from from 0.6735 lows yesterday to over 0.68.00 now. MAs aligned higher, MACD signal line & histogram hold over 0 line, RSI 62 & rising, Stochs in OB zone. H1 ATR 0.0011, Daily ATR 0.0070.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.