The last time I commented on Turkish economy perspectives, I mainly suggested that the country’s troubles were endemic given the country’s high dependency on external financing, the political situation in the country, and the Central Bank’s unwillingness to raise interest rates. Since then, the USDTRY has remained below 7, albeit the overall trend appears to be upwards, with the bottom of each correction phase getting progressively higher.

The rate hike on September 13, from 17.75% to 24%, calmed the markets in the short run and resolved one of the three issues, but has still not put an end to the Lira’s troubles. The decline to 6.06 last Friday, has seen an increasing trend reaching 6.40 by the time of writing of this article. Markets do not appear to believe that trouble is over for Turkey, which is experiencing an increasing rate of inflation in the past months, reaching 17.9% in August compared with an inflation rate of 10.7% last year.

The sanctions imposed by Donald Trump are supposedly to be met with a boycott of US electronic products, although this appears to be too vague to be true. In addition, Turkey will get itself in a more difficult position if it starts boycotting products, given that it registers an import content of exports of approximately 35% across all its manufacturing industries.

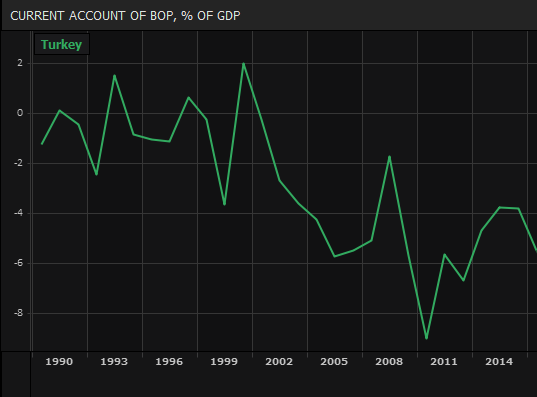

Further to the imposition of sanctions, which have made the world realize that the country is in a tight spot, the issue appears to be that Turkey has lost most of the appeal it had during the early 2000s. Turkey has been running huge current account deficits, averaging at 5.6% of GDP in the past 8 years, and is expected to be close to 7% of GDP in 2018. At the moment, the January-July current account balance is approximately $7 bln worse than last year. To fund this deficit, the country relies on capital flows, which mainly take the form of Foreign Direct Investment (FDI) and deposit liabilities. The usual issue with deposit liabilities is that these are usually short-term and can flow out of the country quite fast, literally by clicking a button.

A freeze in FDI flows can also deliver a hard blow in a country in which, on average, obtains $7bln of FDI per year, with half of this investment coming from European countries (Austria, Netherlands, Spain and Germany).This is not just an outcome of the recent Lira depreciation. According to the OECD, return on investment for inward FDI has been lower than most other countries, developed and developing, standing lower than 3%. Recent data show that investors have caught up with this, up to a point, as total FDI decreased by approximately 33% in January-July 2018, compared to the same period in 2017, a reduction coming mainly from European countries, and to a lesser degree Asian countries (including Middle East).

Banks in Turkey are another weak link in the chain of events. Following the Lira depreciation, long-term debt repayments amounting to USD24 bln would rise from TRY 112 bln in January 2018 to TRY151 bln at current prices. Banks may have started feeling this pain as debt issuance was just $100 mln in June and July; it could also be that foreigners are less willing to purchase given the additional debt burden banks will have to endure.

This is not the only problem banks will have to face in the future: approximately 40% of domestic loans are denominated in foreign currency and the depreciation will make it much more difficult for borrowers to repay as well as for banks to recover the full loan amount. Similarly, 50% of total deposits are in foreign currencies, making the overall amount of interest paid much higher in TRY. Interestingly, for the week ending on September 7, total loans to the non-financial sector have declined, while interest rates increased by more than 2% in most loan categories. This data covers the week before the interest rate hike thus, given the 6.25% rate hike and the fact that the Turkish central bank has allowed for further increases in credit card interest rates as of October, credit conditions are likely to rise dramatically for most consumers. The combination of all of the above could lead to a banking crisis, even though it is still too early to judge whether credit conditions have tightened by that much.

With the continued depreciation of the Lira, and with bleak future prospects, investments may end up looking like a carry trade gone bad: the 19% drop in the value of the Lira since August can be enough to wipe out all profits made during the year, even at a 17.75% interest rate. Some European banks also appear to be heavily exposed to Turkey, notably BBVA and UniCredit, while other companies also have Turkey exposure such as Fiat Chrysler and Befesa, as Bloomberg reports. If the Lira follows this downward trend, European equities with investments in the country are likely to suffer, despite the fact that most markets have not yet registered any sign of stress.

The recent announcement of a plan to slash government spending, which aims at slowing growth and taming inflation, does not appear to have convinced investors. Despite the fact that banks have signed an agreement in which they agree to support loan repayment, this only applies to debtors which owe at least TRY100 mln, i.e. not the vast majority of borrowers. Furthermore, slashing government spending would also mean that Turkish households will face a deterioration in their purchasing power with this also having an effect on government revenue. Consequently, the government plan is more likely to weigh negatively on the economy, in a similar manner to how austerity measures affected the European periphery.

Overall, the economic situation in Turkey is shakier than it appears. Unless measures are taken to address the banking sector issues and the rising inflation costs then conditions in the country are bound to worsen. Markets understand this as the Lira has not moved significant from the 6.20 level, which could serve as a floor in the case that Turkey’s macro outlook worsens.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.