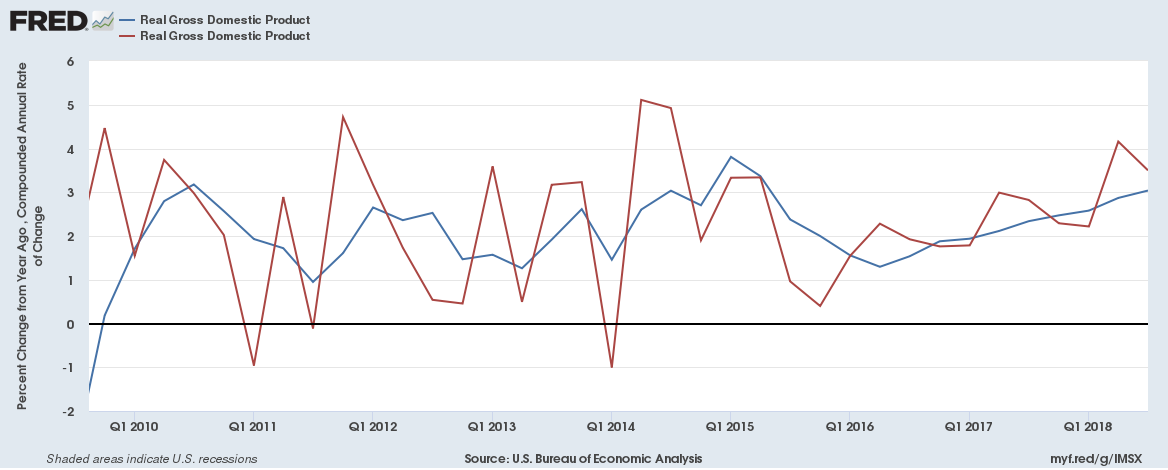

The US economy has been growing impressively in the past years, with GDP increasing by 2% or more on a y/y basis since 2017. The latest number, at 3% on a y/y basis is also supportive of this trend (blue line). The recent worry is that the annualized growth rate (red line) has declined from 4.2% last quarter to 3.5% this quarter. As already discussed, this is nothing but a hypothetical estimate which shows how much the economy would have grown in the course of a year if the same growth rate persisted. As you may have guessed, this is a number which is more likely to fluctuate across quarters.

This implies that we shouldn’t take the change in Q3 annualised GDP that seriously. In addition, real GDP is still growing very fast, even if slower than last quarter. Note that this does not really have anything to do with the state of the US economy or the Fed rate hike but more with the hurricane season which also pushed NFP numbers down earlier this month. Worries about distress in the US economy appear to be rather unfounded; people tend to be so forward looking that they forget all about what happened three weeks ago. Allow me to elaborate on why, on the domestic, private sector front, the US economy does not appear to be fragile at all.

To begin with, interest rate hikes do not pose that much of a threat to the US economy, at least for the private sector. The gradual rate hikes are small and are mainly aimed at the demand side of bank lending. In essence, interest rates aim to make loans less attractive for the private sector while they are not expected to have any impact on the banks’ willingness to grant new loans. Most importantly, rate hikes do not have an effect on individuals’ creditworthiness and hence it shouldn’t make any difference as to whether a bank will be willing to offer someone a loan. Naturally, if banks decide that they are willing to grant loans to riskier individuals, as in the subprime crisis, then there is really no way the Central Bank’s interest rate is going to stop them from doing it. As such, this should not make that much of a difference, other than borrowers having to pay a higher interest amount each month, which is exactly what the Fed’s aim is when increasing rates. As expected, loans have continued to grow by more than 4% on a y/y basis.

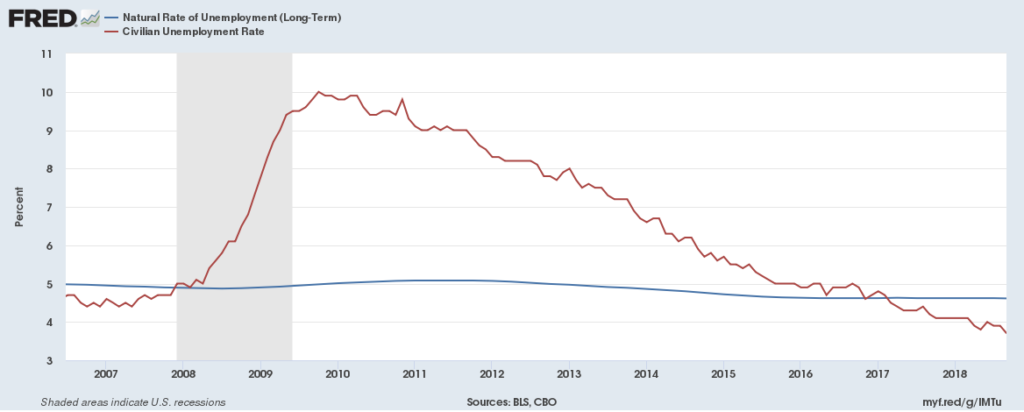

Again on the domestic front, the labour market appears to also be quite strong: the unemployment rate is below the natural rate of unemployment again suggesting that the economy is growing and that the Fed’s rate hikes did not cause much harm. NFPs, despite their recent miss due to the hurricane season, are expected to return to their trend, as consensus forecasts suggest. In addition, manufacturing indices are also supportive as Industrial Production and Retail Sales keep growing. Inflation is also supportive of these developments as it has been growing by more than 2% for more than a year. In general, there does not appear to be much cause for worry when it comes to domestic private sector developments.

The only issue with the Fed rate hikes is that these are expected to increase the cost of debt for the US government. This is the main point of the Fed/government dispute, and I’m actually amazed as to why commentators do not mention it that often: the US paid almost 2 trillion Dollars on interest payments in 2017 and is expected to surpass the 2 trillion mark this year. According to the US Treasury, average yields were approximately 27 basis points higher in September 2018 compared to the same month last year. With rates increasing, refinancing debt will mean that more interest will have to be paid. This will push the US debt higher and make it less sustainable. For the Trump administration, a higher cost of debt would mean that it would have to curtail spending or stop the generous tax cuts, either of which will have a drag on growth. As rate hikes are expected to continue in 2019, the Trump administration understands that the need for fiscal discipline will become more pressing, at a time when he would prefer to be spending to increase his re-election campaign in 2020.

The Trump administration has another reason to be pessimistic about the future and that is the impact of the trade war between the US and China. At the moment, the US has imposed tariffs on more than $300 billion worth of Chinese imports, while China has retaliated by targeting about $110 billion of its imports from the US. Overall, the US has targeted about 60% of Chinese imports (ironically including products such as iPhones) while China has targeted approximately 85% of US imports. The effects from the tariffs are more likely to affect the US economy than China, as prices of imported goods will likely rise (hence also pushing inflation higher) since the US cannot easily replace all goods from its largest import source. Furthermore, Chinese tariffs are also expected to hurt corporate profits, as many firms have a significant exposure to the Chinese market. As Yahoo!Finance estimates, approximately 30% of Apple and 10% of Intel’s revenue stems from China, while corporates which are not on the list, such as Ford, have already reported weakened profits on account of lower sales and higher prices of metals (told you so a month ago).

To sum up all of the above, the problems with the US economy do not really lie in its domestic, private sector. They lie in the fiscal balance, which has been increasing and is expected to increase further in 2018 and the US-Sino trade war which has raised prices of raw materials for firms and reduced demand for their products and services in China. The Fed interest rate hike is correct and it should proceed with another in December in order not to jeopardize its reputation. However, even if the Fed hates doing so, it will be forced to slow down rate hikes in 2019, in the case that the US government pursues with the same policies in the fiscal and external sectors. That is unless the Fed is willing to go on a full-on attack on the Trump administration and maintain the current policy stance of raising interest rates.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.