The big news last week was the imposition of economic sanctions on Russia by the US. According to the US Department of State, the official start date of the sanctions is August 22, 2018. In addition to the already existing restrictions, targeting specific people due to their activities, sanctions will now prohibit the export of most military and security-related items, as well as the denial of any sort of state financing related to these issues.

While this may not appear to be large at first, approximately 50% of licenses for export to Russia have historically included at least one national security controlled item. By Dollar value, the top categories of items tend to be things like air gas turbine engines, electric – electronic devices and components, integrated circuits, test and calibration equipment of various sorts, materials, and various similar things.

Then wait: exports? Shouldn’t the US be more affected by sanctions than Russia in this case? After all, isn’t Russia paying to get the goods from the US? While this is correct, US exports to Russia amount to only 0.5% of total exports in 2016 (the latest available detailed data), while the US share of Russian imports is approximately 3.8%, or $6.8 bln. The issue here is that most of Russia’s imports from the US are what one would classify as high-tech, ranging from machines to cars and vehicle parts, to chemical products and instruments (e.g. medical), i.e goods which are actually easier to import than to spend money and time into developing. Most importantly, these imports are also very useful in the production of other goods, which are then used for exporting purposes. This is called the percentage of import content in exports, and stood at about 13.7% for Russia, according to the World Bank. In addition, the ban covers all Russian state-owned or state-funded enterprises which the US Department of State estimates to be covering approximately 70% of the Russian economy and 40% of the national workforce. Hence, the sanctions can have an indirect effect on the Russian economy, provided that the country finds no way of replacing US imports with imports from other countries.

The above effects will be dwarfed, however, by the impact of the second round of sanctions if Russia does not comply with the criteria specified in the US CBW Act of 1991 within 90 days from the announcement. The criteria specify that: first, Russia will no longer be using chemical or biological weapons in violation of international law, or lethal chemical or biological weapons against its own nationals; second, that Russia will provide reliable assurances that it will not in the future engage in such activities; and, third, that Russia is willing to allow on-site inspections by United Nations observers or other internationally recognized impartial observers, to ensure that the government is not using chemical or biological weapons.

If the criteria are not met, the US government shall move to more drastic measures. These consist of:

- denying the extension of any loan (including financial and technical assistance) by international financial institutions such as the IMF,

- prohibiting any US bank from making loans or providing credit to the Russian government,

- prohibiting all exports to Russia (excluding food and other agricultural commodities and products),

- restricting imports from Russia (including petroleum and petroleum products), and

- downgrading or suspending diplomatic relations.

According the figure below, Russia’s exports to the US mostly comprise of petroleum which would probably be one of the targeted items. Overall, US imports from Russia stand at approximately $12.3 bln, accounting for approximately 4.6% of total Russian exports. In a country which appears to have just escaped a recession in 2017, $12.3 bln could be an important chunk. Exports of goods are the major cause of concern, given that foreign direct investment (FDI) from the US to Russia stands at approximately the same amount such as FDI from Russia to the US, which suggests that the impact would most likely be minimal.

Source: Observatory of Economic Complexity

Let’s now sum up all the above information to estimate the potential impact sanctions could have on the Russian economy. The worst case scenario would be that Russia does not meet the criteria and this leads to breaking trade ties with the US. This would suggest that the whole of the $12.3 bln of exports is lost, however, given that Russia will also no longer import from the US, the net amount of losses through this simplified exercise should stand at approximately $5.5 bln ($12.3 minus $6.8). Then, remembering that approximately 13.7% of imports is used for exporting purposes, approximately $1 billion of exports (13.7% of $6.8 bln) are expected to be affected. Thus, the effect should amount to $6.5 bln, or approximately 0.4% of Russian GDP, which would lower growth but it does not appear large enough to push the country into recession. Furthermore, a lower exchange rate would make Russian goods more price-competitive which could also have a positive impact on the country’s GDP. Naturally, the effect of the sanctions could be amplified if these are coupled with lower oil prices, and/or more sanctions by other countries. The big question with regards to Russia relates to the health and viability of its financial system, and is unfortunately one we cannot safely gauge. Approximately 60% of total banking assets in the country are now state-owned, which appears to have eased financial trouble in the country, but again no solid conclusions can be reached.

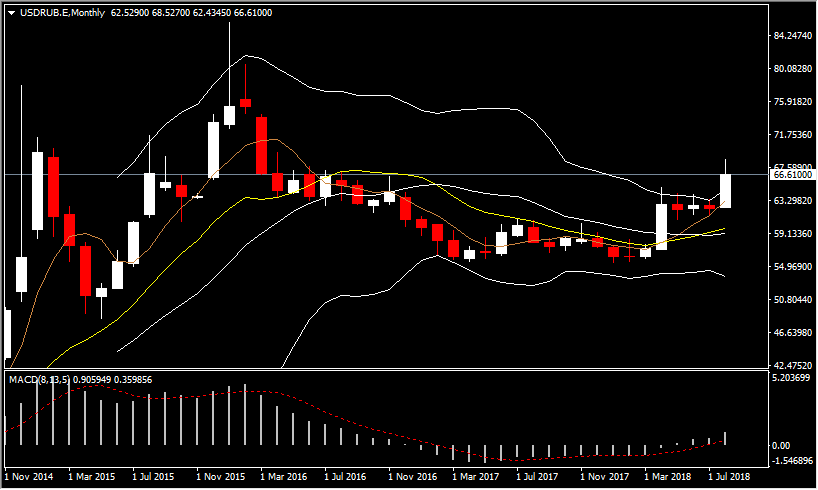

One final thought: while the estimation of the potential impact from the economic sanctions appears to be large, the perception of a large impact as well as rippling effects from the Turkish Lira’s fall was enough to depreciate the Ruble by 5% over the last week. In short, perceptions matter for short-term fluctuations. Nonetheless, the Russian economy does not appear to look anything like Turkey’s at this point in time, and if not coupled with any of the other effects described in the previous paragraph, there does not appear to be a significant cause for a long-term continuation of the Ruble depreciation.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/15 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.