FX News Today

- Thursday’s rally on Wall Street failed to boost Asian markets, which struggled as the impact of easing hopes following dovish comments from Fed, BoJ and ECB faded and trade angst returned.

- US-Iran tensions also weighed on sentiment. The New York Times reported that US President Trump had actually approved military strikes after Iran shot down a US military drone, but pulled back from launching the attacks.

- The Nikkei fell back -0.8%, although the Shanghai Comp still managed a gain of 0.5% amid lingering hopes of progress on US-Sino trade talks ahead of the leaders meeting at the sidelines of the G-20 meeting next week.

- The USA500 managed a record high yesterday as markets position for rate cuts, but US futures are slightly in the red after a cautious session in Asia and GER30 futures are also down.

Charts of the Day

Technician’s Corner

- USOIL advanced as much as 6%, up over $3, at June highs of $57.37. The downing of a US drone in the Persian Gulf got the rally rolling, with gains since coming following a Trump tweet, which just said “Iran made a very big mistake!”Following the tweet, prices moved up from near $56.20 to session highs. Immediate Support today hold at $56.00, while on the break of it 55.20 could be retested. On the flipside, Resistance $58.50-59.00 as stated in our post yesterday.

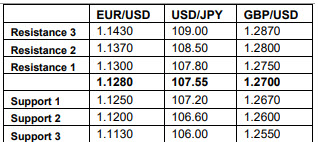

- Cable has lost upside traction, with the pair having settled 25-35 pips below the highs. The BoE trimmed its Q2 GDP growth estimate to 0.0% q/q from 0.2% while stating that inflation remains well anchored. Cable earlier printed an 8-day high at 1.2727. The Pound has fared less well against the Euro, losing ground today against the common currency. The UK currency has been trading with a 10-15% trade-weighted Brexit discount since the vote to leave the EU in June 2016, and this is not expected to change. Cable has resistance at 1.2730 and Support at 1.2665.

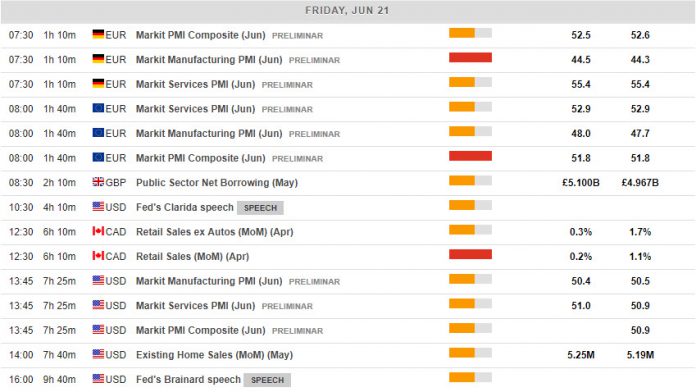

Main Macro Events Today

- Markit Manufacturing PMI (EUR, GMT 07:30) – The Preliminary Manufacturing PMIs in Germany and Eurozone are expected to increase in June, to 44.5 and 48.1 respectively.

- Retail Sales and Core (CAD, GMT 12:30) – Canadian sales are expected to slip 1% in April, with a 0.9% gain excluding autos, following a 1.1% figure for the March headline and a 1.7% increase ex-autos.

- Markit Manufacturing PMI (USD, GMT 13:45) – The Preliminary Manufacturing and Services PMIs are expected to increase in June, to 52.5 and 53.2 respectively.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.